Share Post

The Federal Budget for fiscal year 2022-23 was released on April 6th and contains a number of measures that will impact hospitality businesses. Given this budget’s focus on pandemic recovery and economic growth, understanding how it affects you is essential for your business’s success. Let’s break down some of the key points.

JobMaker Hiring Incentive

The JobMaker Hiring Incentive is a $4 billion plan to incentivize companies to hire young people aged 16-35 years old. Companies that hire eligible jobseekers will receive up to $200 per week for 12 months, with up to $100 per week available for those aged between 30-35. This measure is expected to create 450,000 new jobs in total and should help hospitality businesses struggling to fill vacancies due to the pandemic.

Tax Changes

The budget also included changes to income tax rates, with individuals earning between $45,001 – $120,000 now paying less tax in 2021-22 than they did in 2020-21. Furthermore, all individuals can expect further tax relief from July 1st, 2022 onwards when the first stage of the government’s 7-year Personal Income Tax Plan kicks in. This means more money back into people’s pockets which could lead to an increase in spending within hospitality businesses across Australia.

GET STARTED

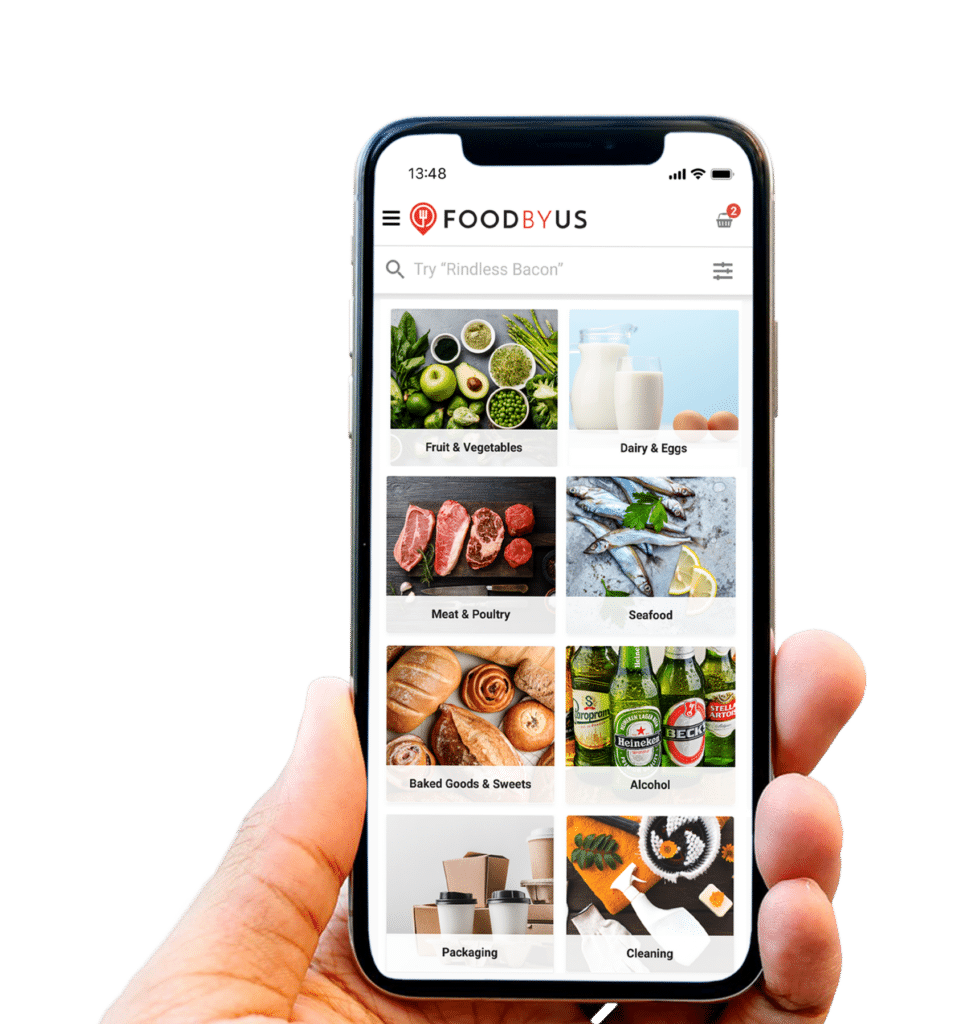

We’ll help your restaurant thrive

In the changing world of hospitality, our platform is here to grow your business during challenging times.

SME Loan Guarantee Scheme

The Small and Medium Enterprises (SME) Loan Guarantee Scheme has been extended until June 30th, 2022 as part of the budget announcement. This scheme offers eligible SMEs access to unsecured loans up to $250,000 with no interest payable or principal repayments required for two years from the loan settlement date – so long as lenders agree not to take loan repayment action during this period if your business experiences financial difficulty due to coronavirus events beyond your control. If you are considering taking out a loan, it’s worth speaking with your lender about this scheme and whether you meet the eligibility criteria.

This budget provides much-needed support for hospitality businesses in Australia that have been impacted by COVID-19 restrictions over the past year or so. While there are still many challenges ahead as we continue our recovery process, understanding these key measures of the federal budget can help small business owners make informed decisions about their future operations and ensure their business remains viable into next year and beyond. With additional incentives such as JobMaker Hiring Incentive and SME Loan Guarantee Scheme combined with lower taxes for individuals across Australia, this Federal Budget looks promising for those within the hospitality industry looking towards a brighter future ahead!

Share Post